Best Investment Strategies for Long-Term Growth

Investing can be an effective way to grow your wealth over the long term. However, with so many investment options available, it can be challenging to decide which strategy is best for you. In this article, we will discuss the best investment strategies for long-term growth, taking into account factors such as risk tolerance, time horizon, diversification, and investment goals.

Introduction

Investment strategies refer to the methods investors use to select investments and allocate assets in their portfolios. The primary objective of an investment strategy is to achieve specific financial goals while minimizing risk. Choosing the right investment strategy is crucial for long-term growth, as it can determine the performance of your investment portfolio over time.

Types of Investment Strategies

Investment strategies can be broadly categorized into two types: passive and active.

Passive Investment Strategies

Passive investment strategies involve investing in assets that track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These strategies require little maintenance and typically offer lower fees than active investment strategies.

Buy and Hold

The buy and hold strategy is a passive investment strategy that involves investing in a diversified portfolio of assets and holding onto them for an extended period, regardless of market fluctuations. The goal of this strategy is to achieve long-term capital appreciation.

Index Funds

Index funds are mutual funds or exchange-traded funds (ETFs) that track a specific market index, such as the S&P 500. These funds invest in a diversified portfolio of assets that replicate the performance of the index they track.

Active Investment Strategies

Active investment strategies involve a more hands-on approach to investing, with investors actively managing their portfolios to achieve better returns than the market average.

Value Investing

Value investing involves investing in companies that are undervalued by the market but have strong fundamentals. The goal of value investing is to buy stocks at a discount and hold onto them until they appreciate in value.

Growth Investing

Growth investing involves investing in companies that are expected to experience above-average growth in revenue and earnings. The goal of growth investing is to invest in companies with high potential for growth and hold onto them for the long term.

Variables to Consider While Picking a Venture Methodology

Before choosing an investment strategy, it is essential to consider several factors, including your risk tolerance, time horizon, diversification, and investment goals.

Risk Tolerance

Risk tolerance refers to your willingness to take on risk in your investment portfolio. If you have a low risk tolerance, you may prefer more conservative investments, such as bonds or index funds. If you have a high risk tolerance, you may be more comfortable with riskier investments, such as individual stocks.

Time Horizon

Your time skyline is the timeframe you intend to hold your speculations. If you have a short time horizon, you may prefer more conservative investments, such as bonds or money market funds, to protect your capital. If you have a longer time horizon, you may be more comfortable with riskier investments that offer higher potential returns, such as stocks or mutual funds.

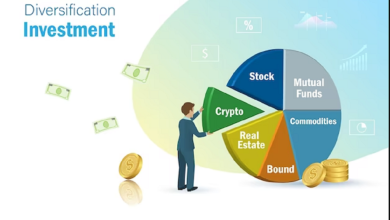

Diversification

Broadening is the act of putting resources into different resources for lessen risk. By spreading your investments across multiple asset classes, such as stocks, bonds, and commodities, you can minimize the impact of any one asset on your portfolio’s overall performance.

Investment Goals

Your venture objectives ought to be explicit, quantifiable, and time-bound. Some common investment goals include saving for retirement, buying a home, or paying for a child’s education. Understanding your investment goals can help you choose the right investment strategy and make informed investment decisions.

Best Investment Strategies for Long-Term Growth

Now that we have discussed the different types of investment strategies and factors to consider when choosing an investment strategy, let’s explore the best investment strategies for long-term growth.

Dollar-Cost Averaging

Mitigating risk is a technique that implies financial planning a decent measure of cash at normal stretches, paying little mind to economic situations. This approach can help minimize the impact of market volatility on your portfolio and allow you to buy more shares when prices are low.

Buy and Hold

The buy and hold strategy involves investing in a diversified portfolio of assets and holding onto them for an extended period, regardless of market fluctuations. This strategy can help minimize transaction costs and taxes and allows you to benefit from long-term capital appreciation.

Index Funds

Index funds are mutual funds or ETFs that track a specific market index, such as the S&P 500. These funds invest in a diversified portfolio of assets that replicate the performance of the index they track. Index funds are a popular choice for investors looking for a low-cost, passive investment strategy.

Value Investing

Value investing involves investing in companies that are undervalued by the market but have strong fundamentals. The goal of value investing is to buy stocks at a discount and hold onto them until they appreciate in value. This strategy can be effective over the long term, but it requires careful research and analysis of individual stocks.

Growth Investing

Growth investing involves investing in companies that are expected to experience above-average growth in revenue and earnings. The goal of growth investing is to invest in companies with high potential for growth and hold onto them for the long term. This strategy can be riskier than value investing but can offer higher potential returns.

Diversification

Diversification is essential for long-term growth, as it can help reduce risk and increase the stability of your portfolio. By investing in a variety of assets, you can minimize the impact of any one asset on your portfolio’s overall performance and benefit from the long-term growth of multiple asset classes.

Conclusion

Choosing the right investment strategy is crucial for long-term growth. By considering factors such as risk tolerance, time horizon, diversification, and investment goals, you can select an investment strategy that aligns with your financial objectives. The best investment strategies for long-term growth include dollar-cost averaging, buy and hold, index funds, value investing, growth investing, and diversification.

FAQs

- What is the distinction among detached and dynamic venture procedures? Passive investment strategies involve investing in assets that track a specific market index, while active investment strategies involve actively managing a portfolio to achieve better returns than the market average.

- What is dollar-cost averaging? Minimizing risk is a technique that implies financial planning a proper measure of cash at normal spans, paying little heed to economic situations.

- What is the buy and hold strategy? The buy and hold strategy involves investing in a portfolio of assets and holding onto them for an extended period, regardless of market fluctuations.

- What are index funds? Index funds are mutual funds or ETFs that track a specific market index, such as the S&P 500. These funds invest in a diversified portfolio of assets that replicate the performance of the index they track.

- What is diversification? Expansion is the act of putting resources into different resources for diminish risk. By spreading your investments across multiple asset classes, such as stocks, bonds, and commodities, you can minimize the impact of any one asset on your portfolio’s overall performance.