how to invest in the stock market and make money in 7 days

Investing in the stock market with the expectation of making significant profits in a very short time frame like 7 days is highly risky and not recommended for most investors. The stock market is unpredictable in the short-term, and while it’s possible to make money quickly, it’s equally (if not more) possible to lose a substantial amount.

However, if you are determined to participate in short-term trading, here are some strategies that traders use, but remember, these come with high risk:

- Day Trading: This involves buying and selling stocks within a single market day. Day traders aim to profit from short-term price fluctuations.

- Swing Trading: This strategy involves buying and holding a stock for a few days or weeks. The goal is to capture short-term trends.

- Technical Analysis: This involves analyzing statistical trends gathered from trading activity, such as price movement and volume. Traders use this information to predict future price movements.

- Momentum Trading: This strategy involves buying stocks that are trending in one direction on high volume.

Remember, these strategies require a deep understanding of the stock market, substantial time for research and monitoring, and a high tolerance for risk. They can result in significant financial losses.

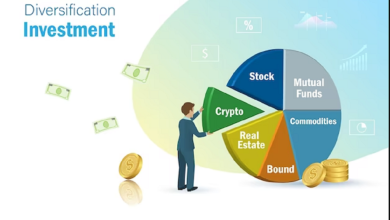

Long-term, diversified investing is generally a more reliable and successful strategy for individual investors. If you’re new to investing, consider seeking advice from a financial advisor before making any decisions. It’s important to understand your risk tolerance and investment goals.

What is the best platform to invest in the stock market?

There are several platforms to invest in the stock market, and the best one for you depends on your preferences, investment goals, and the services you require. Here are some popular platforms to consider:

- TD Ameritrade: Known for its extensive research tools, user-friendly platform, and excellent customer service, TD Ameritrade is a solid choice for both beginners and experienced traders.

- ETRADE: ETRADE offers a comprehensive trading platform with a wide range of investment options, including stocks, ETFs, mutual funds, and options. They also provide educational resources and trading tools.

- Fidelity: Fidelity is known for its research capabilities, low fees, and diverse investment options. It’s a great platform for long-term investors looking to build a diversified portfolio.

- Charles Schwab: This platform offers a wide range of investment options, including stocks, ETFs, mutual funds, and options. They also provide excellent research tools and customer support.

- Robinhood: Robinhood is a mobile-first trading platform that offers commission-free trading in stocks, ETFs, and options. It’s popular among younger investors and those new to investing due to its simple, user-friendly interface.

- Interactive Brokers: This platform is best suited for advanced traders and global investors. They offer a wide range of investment options, including stocks, ETFs, options, futures, and forex. Interactive Brokers also provides powerful trading tools and low fees.

When choosing a platform, consider factors like fees, investment options, research tools, customer support, and ease of use. It’s a good idea to compare multiple platforms and read reviews to find the one that best suits your needs.